Credit Scoring for Small Business Derived From Over $1.4 Trillion in Loans

Request a Demo

Trusted Customers & Partners

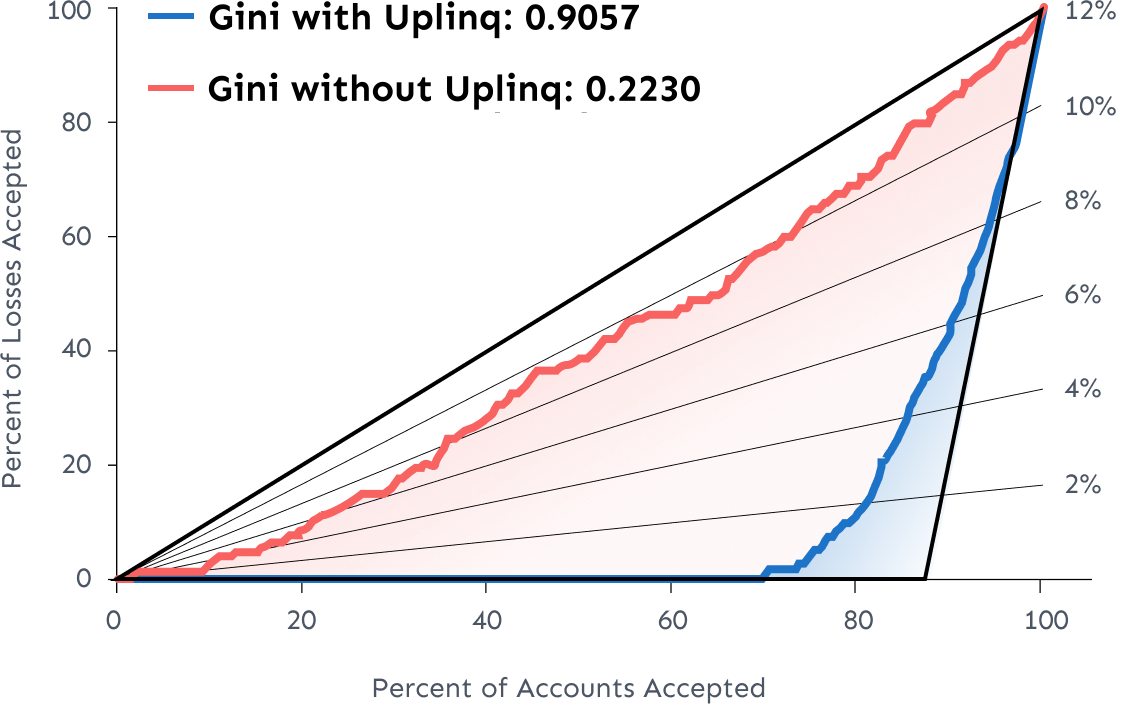

Transformational Customer Results

65% – 112%

increase in loan approvals.

47% – 54%

increase in net credit margin.

181% – 750%

improvement in credit quality.

10s of Millions

of $ to the bottom line per year.

100s of Millions

of $ over 3 – 5 years.

Millions

in additional working capital impacting local communities.

Enhance Credit Decisions

Uplinq Financial Technologies leverages billions of expanded data sets to provide credit decisioning support for small business lenders worldwide.

Uplinq’s core mission is to facilitate fair credit access for small business owners worldwide by empowering lenders to approve significantly more loans, particularly benefiting minority and underserved segments that might have otherwise been declined.

Uplinq’s core mission is to facilitate fair credit access for small business owners worldwide by empowering lenders to approve significantly more loans, particularly benefiting minority and underserved segments that might have otherwise been declined.

Compliance

Internal and regulatory compliance is expensive, difficult to enforce, and labor intensive. Uplinq’s technology can integrate most lending compliance standards within our digital decision support tools. With Uplinq, satisfaction of Fairness, Safety and Soundness, Data Security and other mission critical requirements become inherent to the decision making process, with the confidence that comes with near perfect compliance and with little effort demanded of the lenders we serve.

-

Exceeds SR 11-7, IFRS-9, Basel III requirements, and all compliance and regulatory standards unique to each lender we serve

-

White box solution. Transparent and reviewable AI.

-

Soc 2, Type 2 compliant

While combining AI powered insights and analytics, Uplinq leverages over 10,000 unique data sources to help financial providers improve credit scoring and default management with confidence.

Derek Ellington

Former EVP, Head Small Business Banking, Wells Fargo